Advanced Disability Benefits Estimator

Discover Your Potential Benefits

Are you curious about what disability benefits you might qualify for? Let's find out together!

Understanding the intricacies of disability benefits is crucial for Texas residents who rely on these payments for financial support. The  Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) are two vital programs that provide financial assistance to individuals unable to work due to a disability.

Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) are two vital programs that provide financial assistance to individuals unable to work due to a disability.

The recent 2.5% COLA adjustment for 2025 has impacted payment amounts, making it essential to comprehend the payment charts and eligibility requirements. By grasping how disability benefits are calculated, recipients can better plan their finances and maximize their benefits.

This comprehensive guide will walk you through the payment charts, eligibility criteria, and calculation methods specific to Texas residents, providing valuable insights into the average disability benefit amounts in Texas compared to national averages.

Understanding Disability Benefits in Texas

Understanding the nuances of disability benefits is essential for Texas residents who are unable to work due to a medical condition. The Social Security Administration (SSA) offers two primary disability benefit programs: Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI).

Types of Disability Benefits Available in Texas

Texas residents have access to two main disability benefit programs. SSDI is funded through payroll taxes and requires applicants to have worked and earned sufficient work credits. In contrast, SSI is a needs-based program designed for low-income individuals with limited resources. Both programs have distinct eligibility criteria and application processes.

Eligibility Requirements for Texas Residents

To qualify for SSDI, applicants must have a medical condition that prevents substantial gainful activity and is expected to last at least 12 months or result in death. They must also have worked and paid Social Security taxes for a sufficient period. SSI eligibility, on the other hand, is based on financial need, with strict income and resource limits. Texas residents must meet these SSA-defined criteria to receive disability benefits.

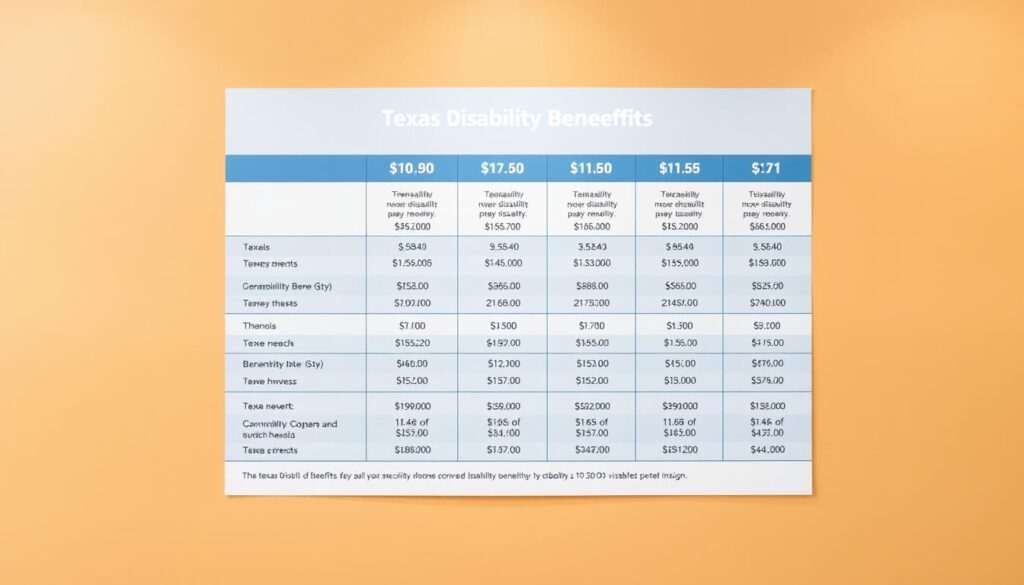

Social Security Disability Benefits Pay Chart Texas

The Social Security Disability Benefits Pay Chart in Texas provides valuable insights into the financial assistance available to individuals with disabilities. Understanding the average payment amounts for Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) is crucial for recipients to manage their expectations and plan their finances effectively.

Average SSDI Payment Amounts in Texas

The average monthly SSDI payment in Texas is $1,463.70. This amount is influenced by factors such as work history, lifetime average earnings, and the age at which the disability began. Compared to national averages and neighboring states, Texas SSDI payments are relatively consistent, reflecting the standardized nature of the SSDI program.

Average SSI Payment Amounts in Texas

The average monthly SSI benefit in Texas is $583.16. SSI payment amounts are generally lower than SSDI because they are based on financial need rather than work history. Some recipients may qualify for both SSDI and SSI if their SSDI benefit is low enough to meet SSI income requirements.

2025 Social Security COLA and Its Impact on Texas Benefits

A 2.5% increase is on the horizon for Social Security beneficiaries in Texas for 2025. The Social Security Administration (SSA) has announced a Cost-of-Living Adjustment (COLA) based on the Consumer Price Index, which measures changes in everyday goods’ prices.

How the 2.5% COLA Affects Payment Amounts

The 2.5% COLA will result in increased social security payments for Texas recipients. For instance, if the average monthly SSDI payment is $1,500, the new amount will be $1,537.50. Similarly, SSI recipients will see their payments adjusted accordingly.

Historical COLA Adjustments and Trends

Historically, COLA adjustments have fluctuated with inflation rates. Over the past decade, adjustments have ranged from as low as 0.3% to as high as 8.7%. Understanding these trends helps predict future social security benefits changes.

SSDI Payment Schedule for Texas Recipients

The SSDI payment schedule for Texas recipients is determined by their birthdate, ensuring a systematic distribution of disability benefits. This means that the payment date for SSDI benefits varies depending on when you were born.

Payment Dates Based on Birthdate

For SSDI recipients, payments are made on either the second, third, or fourth Wednesday of each month. The specific Wednesday depends on the recipient’s birthdate range.

| Birthdate Range | Payment Date |

|---|---|

| 1st-10th | Second Wednesday |

| 11th-20th | Third Wednesday |

| 21st-31st | Fourth Wednesday |

Special Payment Circumstances

Some recipients may have different payment schedules. For instance, if you began receiving Social Security benefits before May 1997, or if you receive both SSDI and SSI, your payment dates may vary. Specifically, SSDI payments for these individuals are made on the 3rd of each month, while SSI benefits are paid on the 1st.

SSI Payment Schedule for Texas Recipients

Understanding the SSI payment schedule is vital for recipients in Texas. The Social Security Administration (SSA) follows a specific schedule to ensure beneficiaries receive their Supplemental Security Income (SSI) payments on time.

First-of-Month Payment System

The SSA pays SSI benefits on the first day of each month. This first-of-month payment system helps recipients plan their finances. For instance, if you receive SSI, you can expect your payment on January 1, February 1, and so on.

Holiday and Weekend Adjustments

If the first day of the month falls on a weekend or federal holiday, the SSA adjusts the payment date to the preceding business day. For example, if January 1 is a Sunday, SSI recipients will receive their payment on December 31 of the previous year. This adjustment ensures timely access to social security benefits.

Maximum Benefit Amounts for Texas Disability Recipients

The maximum payment amounts for disability benefits in Texas have been updated for 2025, affecting both SSDI and SSI recipients. Understanding these changes is crucial for individuals relying on these benefits.

Maximum SSDI Payment Amounts for 2025

The maximum monthly payment amount for Social Security Disability Insurance (SSDI) in 2025 will be $4,018, representing an increase from $3,822 in 2024. The SSDI benefit amount is determined by the recipient’s work history and lifetime earnings. Few recipients qualify for the maximum amount; most receive lower payments based on their earnings record.

Maximum SSI Payment Amounts for 2025

For Supplemental Security Income (SSI), the maximum monthly payment amount in 2025 will be $967, up from $943 in 2024. The SSI federal benefit rate is determined annually and is significantly lower than the maximum SSDI benefit. Income and resources can affect SSI payment amounts, potentially reducing them below the maximum. Texas residents can check their current benefit amount and projected increases through their mySocialSecurity account.

Veterans Disability Benefits Pay Chart for Texas Veterans

Understanding the VA disability benefits pay chart is crucial for Texas veterans to know their entitlements. The Department of Veterans Affairs (VA) provides tax-free monetary benefits to veterans who have service-connected disabilities.

VA Disability Ratings and Corresponding Payments

The VA assigns a disability rating based on the severity of the veteran’s condition, ranging from 0% to 100%. As of December 1, 2024, veterans with a 10% disability rating receive $175.51 monthly, while those with a 20% rating receive $346.95. For higher ratings, the compensation varies based on dependent status.

Additional Payments for Dependents

Veterans with dependents, such as spouses, children, or dependent parents, may be eligible for additional compensation. For instance, a veteran with a 100% disability rating, a spouse, and no children can receive up to $4,044.91 monthly.

The VA disability benefits system is separate from Social Security disability programs but can complement them for eligible veterans. Understanding these benefits is essential for Texas veterans to maximize their entitlements.

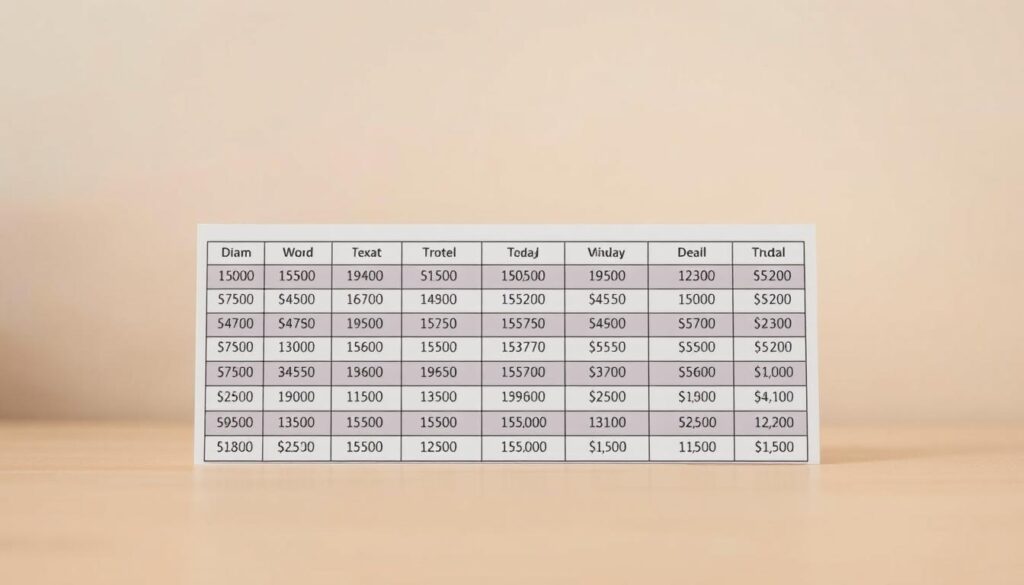

How to Calculate Your Expected Disability Benefits in Texas

Calculating your expected disability benefits in Texas involves understanding the formulas used by the Social Security Administration (SSA) for SSDI and SSI. The SSA uses a complex formula to determine SSDI benefits based on your Average Indexed Monthly Earnings (AIME) and Primary Insurance Amount (PIA).

SSDI Calculation Methods

To estimate your SSDI benefit amount, you’ll need to calculate your AIME, which involves adjusting your past earnings for inflation and then averaging your highest 35 years of earnings. The SSA then applies a formula to your AIME to determine your PIA, which is the amount you’ll receive at full retirement age.

For Texas residents, this process can be simplified by using the SSA’s online benefits calculator. By inputting your earnings history, you can get an estimate of your monthly SSDI payment.

| Earnings Year | Indexed Earnings |

|---|---|

| 2010 | $40,000 |

| 2015 | $50,000 |

| 2020 | $60,000 |

SSI Calculation Methods

SSI payment amounts are calculated based on the Federal Benefit Rate minus countable income. Countable income includes wages, pensions, and certain types of Social Security benefits. However, certain exclusions and deductions may apply, such as the first $20 of most income received in a month.

For example, if the Federal Benefit Rate is $914 and you have $200 in countable income, your SSI payment would be $714.

Back Pay and Retroactive Payments for Texas Disability Recipients

Texas disability recipients often face a lengthy wait for their benefits, making back pay a vital aspect of their financial support. The Social Security Administration (SSA) provides back pay and retroactive payments to individuals who have been approved for disability benefits after a waiting period.

SSDI Back Pay Process

The SSDI program has a mandatory five-month waiting period after qualification. During this time, recipients are not receiving payments, but they are entitled to back pay. The SSA typically delivers back pay in a lump sum 60 days after the claim is approved.

SSI Back Pay Distribution

For SSI recipients, back pay is distributed differently. If the back pay amount exceeds three times the maximum monthly SSI payment ($943 in 2024), it is paid in three installments, six months apart. The first payment is made 60 days after approval.

| Program | Waiting Period | Back Pay Timeline |

|---|---|---|

| SSDI | 5 months | Lump sum, 60 days after approval |

| SSI | None | Installments, based on amount |

Understanding the back pay process and timeline is crucial for Texas disability recipients to manage their financial expectations. For more information on checking the status of back pay, recipients can contact the SSA directly.

Conclusion: Navigating Disability Benefits in Texas

Navigating the complex landscape of disability benefits in Texas requires a thorough understanding of the available programs and their respective payment structures. Texas residents can rely on SSDI and SSI programs for financial assistance, with payment amounts influenced by factors such as work history and inflation.

The 2025 COLA adjustment will impact benefit amounts, and recipients should stay informed about these changes. To maintain eligibility, it’s crucial to understand payment schedules, calculation methods, and maximum benefit amounts. Texas residents can seek assistance from local Social Security offices and advocacy organizations.

Regularly checking mySocialSecurity accounts and staying aware of important deadlines will help recipients manage their benefits effectively.