Advanced Disability Benefits Estimator

Discover Your Potential Benefits

Are you curious about what disability benefits you might qualify for? Let's find out together!

Navigating the complexities of disability benefits and life insurance can be challenging for Louisiana residents. Understanding the Louisiana Disability Benefits Pay Chart is crucial for those receiving or applying for disability benefits.

The interplay between disability benefits and life insurance policies is intricate. Proper planning is essential to ensure that individuals can maintain adequate life insurance coverage while receiving disability benefits.

This guide aims to help readers understand the complex rules governing disability benefits and life insurance in Louisiana. We will cover key topics, including benefit types and strategies for maintaining coverage, to empower readers to make informed decisions about their disability benefits and life insurance protection.

Understanding Louisiana Disability Benefits

Residents of Louisiana can access different types of disability benefits, including SSDI and SSI, which are administered by the federal government. These programs provide financial assistance to individuals who are unable to work due to a disability.

Overview of Louisiana’s Disability Programs

Louisiana’s disability programs include both federal and state-specific benefits. The Supplemental Security Income (SSI) program is a needs-based program with strict asset limitations. To qualify for SSI, an individual’s countable resources cannot exceed $2,000, or $3,000 for a couple.

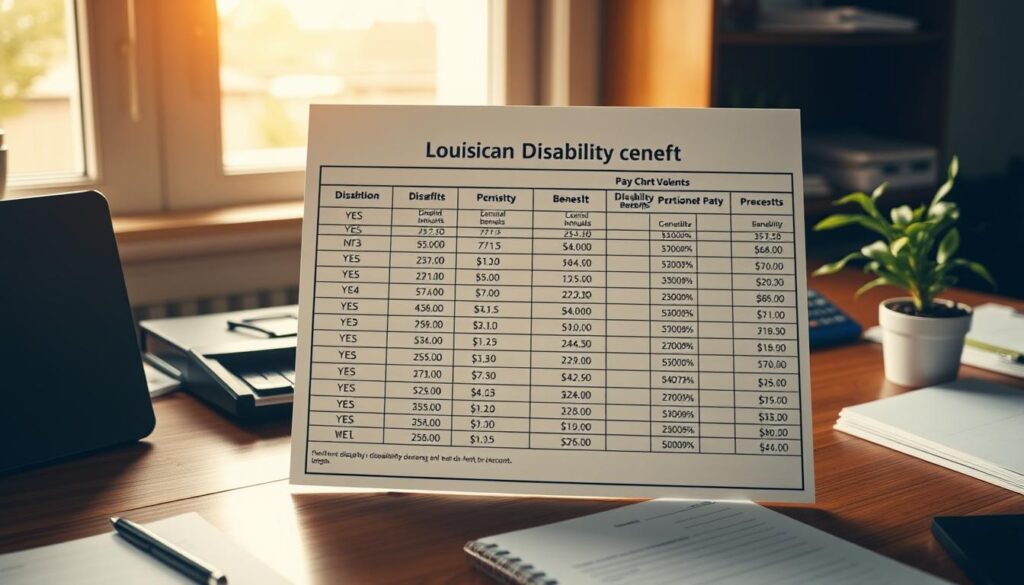

Louisiana Disability Benefits Pay Chart Explained

The Louisiana Disability Benefits Pay Chart is structured to provide payment tiers based on qualification requirements and benefit amounts. The chart varies depending on factors such as disability severity, work history, household size, and other income sources.

The pay chart is designed to ensure that individuals with disabilities receive fair and adequate financial support.

Social Security Disability and Life Insurance: What You Need to Know

For individuals receiving Social Security disability benefits, it’s essential to comprehend how life insurance policies impact their benefits. The interaction between life insurance and Social Security disability benefits can be complex, with significant implications for recipients.

How SSI and SSDI Differ in Louisiana

Supplemental Security Income (SSI) and Social Security Disability Insurance (SSDI) are two distinct programs with different eligibility requirements and benefit amounts. SSI is a needs-based program with strict resource limits, whereas SSDI is based on work history and earnings. In Louisiana, individuals receiving SSI are subject to resource limits, which can be affected by life insurance policies.

| Program | Eligibility Requirements | Benefit Amounts |

|---|---|---|

| SSI | Needs-based, resource limits apply | Varies based on income and resources |

| SSDI | Based on work history and earnings | Based on past earnings |

Resource and Income Limits for Disability Benefits

In Louisiana, SSI recipients are subject to resource limits of $2,000 for individuals and $3,000 for couples. Life insurance policies can impact these resource limits, particularly if they have a cash value. It’s crucial to understand how different types of life insurance policies are treated under SSI and SSDI rules.

The Impact of Life Insurance on Disability Benefits

Life insurance policies can significantly impact disability benefits, especially for SSI recipients. Term life insurance policies typically do not affect SSI eligibility, whereas permanent life insurance policies with a cash value can be considered a resource. Recipients must report any changes in their life insurance policies to avoid potential benefit fraud.

Types of Life Insurance and Their Effect on Disability Benefits

The type of life insurance you choose can significantly affect your disability benefits, making it crucial to understand the various options available.

Term Life Insurance and SSI Eligibility

Term life insurance typically doesn’t have a cash value component, which means it is not considered an asset when determining SSI eligibility. This makes term life insurance an attractive option for disability benefit recipients who need to maintain their benefits without jeopardizing their life insurance coverage.

Permanent Life Insurance: Cash Value Considerations

Permanent life insurance policies, such as whole life, universal life, and variable life insurance, have a cash value component that can impact disability benefit eligibility. The cash value can increase over time and may be considered an asset when determining SSI eligibility.

Which Life Insurance Options Are Best for Disability Benefit Recipients

When choosing a life insurance policy, disability benefit recipients should consider their individual circumstances, including their age, health status, and the type of disability benefits they receive. Term life insurance may be a suitable option for those who need coverage for a specific period, while permanent life insurance may be more suitable for those who require lifelong coverage.

Navigating Resource Limits While Maintaining Coverage

For individuals relying on disability benefits, navigating resource limits is a delicate balance that requires careful planning and management. The Supplemental Security Income (SSI) program has strict resource limits, which can impact one’s ability to maintain life insurance coverage.

Understanding the $2,000/$3,000 Resource Limits

The SSI program sets resource limits at $2,000 for individuals and $3,000 for couples. These limits include cash, stocks, and bonds, as well as certain types of life insurance policies. Understanding how these limits are calculated and monitored is crucial for maintaining benefits.

Exempt Resources That Don’t Count Toward Limits

Not all resources are counted toward the SSI resource limits. Exempt resources include the home you live in, household goods, and personal effects. Life insurance policies with a face value of $1,500 or less are also exempt, along with burial plots and funds up to $1,500. One vehicle used for transportation is exempt regardless of its value.

Strategies for Managing Life Insurance Without Losing Benefits

Managing life insurance policies effectively is key to maintaining disability benefits. One strategy is to restructure existing policies to bring them within the exempt resource limits. Special needs trusts and ABLE accounts can also be used in conjunction with life insurance planning to protect benefits. Regular reviews of resources are essential to avoid benefit disruptions.

By understanding the resource limits and leveraging exempt resources, individuals can maintain necessary life insurance coverage while preserving their disability benefits.

Conclusion: Making Informed Decisions About Disability Benefits and Life Insurance

Navigating disability benefits and life insurance in Louisiana requires a comprehensive understanding of the intricate rules and regulations. Throughout this article, we have explored the critical aspects of Louisiana’s disability benefits and life insurance, including the differences between term life insurance and permanent life insurance, and their impact on disability benefit eligibility.

To maintain financial security, Louisiana residents receiving disability benefits must carefully manage their life insurance policies, adhering to the $2,000/$3,000 resource limits for Supplemental Security Income (SSI) recipients. Strategies such as utilizing exempt resources and consulting with financial advisors specializing in disability planning can help individuals make informed decisions.

Regular reviews of both disability benefits and life insurance coverage are essential, as personal circumstances and program rules change over time. By doing so, Louisiana residents can achieve financial security through both disability benefits and appropriate life insurance protection, ensuring that they can provide for their loved ones while maintaining essential benefits.