Advanced Disability Benefits Estimator

Discover Your Potential Benefits

Are you curious about what disability benefits you might qualify for? Let's find out together!

Supplemental Security Income (SSI) provides financial assistance to individuals with limited income and resources who are disabled, blind, or aged 65 or older. Unlike Social Security Disability Insurance (SSDI), which requires work credits, SSI is designed for those with limited financial means.

To qualify for SSI benefits, applicants must meet specific eligibility criteria beyond medical qualifications. Understanding these non-disability requirements is crucial for a successful application. Key factors include income limitations, resource restrictions, and citizenship or residency requirements.

Many applicants focus on proving their disability but overlook the strict financial and legal eligibility criteria. This guide will break down the complex SSI regulations into clear, actionable information to help navigate the application process successfully.

Understanding SSI and Basic Eligibility Criteria

The Supplemental Security Income (SSI) program is a vital lifeline for millions of Americans who are disabled, blind, or aged 65 and older. To navigate the complexities of SSI, it’s essential to understand its basics and eligibility criteria.

What is Supplemental Security Income (SSI)?

SSI is a federal benefit program administered by the Social Security Administration (SSA) that provides monthly payments to meet basic needs for food, clothing, and shelter. It is designed for individuals with limited income and resources.

Who Can Apply for SSI Benefits?

To qualify for SSI, applicants must be aged (65 or older), blind, or disabled according to SSA definitions. They must also have limited income and resources below established thresholds.

| Eligibility Criteria | Description |

|---|---|

| Age | 65 or older |

| Blindness | Meeting SSA’s definition of blindness |

| Disability | Having a medically determinable impairment that prevents substantial gainful activity |

Difference Between SSI and SSDI

Many people confuse SSI with Social Security Disability Insurance (SSDI), but they have different eligibility requirements. SSDI requires work credits, while SSI is based on financial need regardless of work history. Understanding which program you qualify for is essential as application processes and benefit calculations differ significantly.

By understanding the basics of SSI, including its eligibility criteria and how it differs from SSDI, individuals can better navigate the application process and determine which benefits they may be eligible for.

Non Disability Requirements for SSI: Income Limitations

Income limitations play a significant role in determining whether an individual qualifies for Supplemental Security Income (SSI). The Social Security Administration (SSA) applies strict income guidelines to ensure that SSI benefits are allocated to those who need them most.

What Counts as Income for SSI Purposes?

For SSI purposes, income includes both earned income, such as wages and self-employment earnings, and unearned income, including Social Security benefits, pensions, and gifts from friends and relatives. The SSA considers various types of income when determining eligibility.

Income Exclusions and Exceptions

Not all income counts toward the SSI limit. The SSA excludes certain types of income, such as the first $20 of most income received in a month and the first $65 of earnings plus half of the remaining earnings. Additionally, assistance like food stamps and housing subsidies is not counted as income.

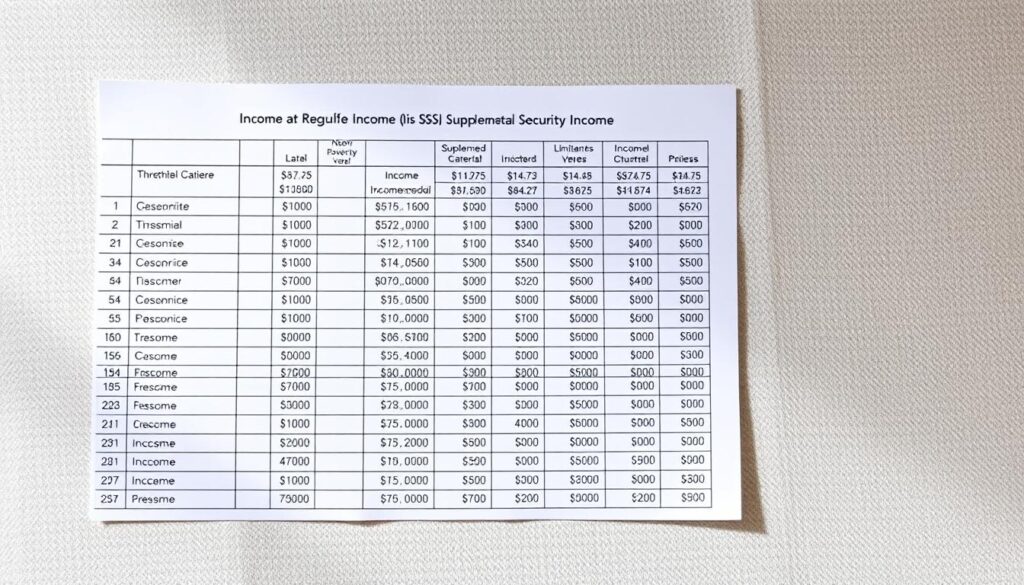

How Income Affects Your SSI Benefit Amount

The SSA reduces SSI benefit amounts by countable income. For 2023, the Federal Benefit Rate (FBR) sets the maximum monthly SSI payment at $914 for individuals and $1,371 for couples. Countable income reduces this amount dollar-for-dollar, meaning that higher income can result in lower SSI benefits.

Reporting Income Changes

It is crucial to report any changes in income to the SSA by the 10th of the month following the change. Failure to report income changes can result in overpayments or underpayments, potentially leading to penalties or benefit termination. The SSA uses retrospective monthly accounting, meaning that income received in one month affects the benefit amount two months later.

Resource Limitations and Property Ownership

Understanding the resource limitations and property ownership rules is crucial for Supplemental Security Income (SSI) eligibility. The Social Security Administration (SSA) sets strict guidelines on what resources are considered when determining eligibility for SSI benefits.

SSI Resource Limits

The SSA imposes resource limits of $2,000 for an individual and $3,000 for a couple. Resources include cash, bank accounts, stocks, bonds, and other assets that can be converted to cash for support and maintenance.

Countable vs. Non-Countable Resources

Not all resources are counted towards the SSI resource limit. Countable resources include cash, bank accounts, investments, additional vehicles, and life insurance policies with face values exceeding $1,500. On the other hand, non-countable resources include your primary residence, one vehicle used for transportation, household goods, and burial spaces.

Transferring Resources and Penalty Periods

Transferring resources for less than fair market value to qualify for SSI can result in a penalty period of up to 36 months. This means that individuals who transfer assets to meet the resource limits may face a period of ineligibility.

Special Rules for Property and Vehicles

Special rules apply to property ownership, particularly for property essential to self-support, such as tools or equipment needed for work. Additionally, vehicle exclusions can extend beyond the primary vehicle if additional vehicles are necessary for medical treatment, employment, or are specially modified for disability use.

Understanding these rules is crucial for navigating the SSI eligibility process, especially for SSDI recipients who may later qualify for SSI. Back payments from SSDI could potentially push resources over the allowable limits, affecting SSI eligibility.

Citizenship, Immigration Status, and Residency Requirements

Citizenship, immigration status, and residency are critical factors that determine an individual’s eligibility for SSI benefits. To qualify for SSI, applicants must meet specific criteria related to these aspects.

U.S. Citizen Eligibility

U.S. citizens and nationals are eligible for SSI if they meet other eligibility criteria. They must provide proof of their status, typically through documents such as birth certificates, passports, or naturalization certificates.

Qualified Alien Categories

Non-citizens face more complex rules. Only “qualified aliens” are potentially eligible under specific conditions outlined in the 1996 welfare reform law. Qualified aliens include Lawful Permanent Residents, refugees, asylees, and certain other categories like those granted withholding of deportation/removal and Cuban/Haitian entrants.

Special Exceptions for Certain Non-Citizens

Most qualified aliens must meet additional requirements, such as having 40 qualifying work quarters or maintaining qualified alien status for at least 5 years. However, special exceptions exist for humanitarian immigrants, including refugees and asylees, who can receive SSI for up to 7 years from the date their immigration status was granted.

Residency Requirements and Living Arrangements

Residency requirements mandate that recipients live in one of the 50 states, the District of Columbia, or the Northern Mariana Islands. Benefits are suspended during extended foreign travel. Living arrangements significantly impact SSI benefit amounts, categorized into living in your own household, someone else’s household, or an institution.

How Living Arrangements Affect Benefit Amounts

Recipients living in another person’s household and receiving both food and shelter may have their benefits reduced by up to one-third through the Value of One-Third Reduction rule. Special rules apply to various living situations, including homeless individuals and those in medical institutions or public shelters. Changes in living arrangements must be reported promptly as they can significantly affect monthly benefit amounts.

Conclusion: Applying for SSI and Next Steps

Navigating the Supplemental Security Income (SSI) application process requires a thorough understanding of both medical and non-medical eligibility criteria. To successfully secure benefits, applicants must be prepared to provide comprehensive documentation, including proof of identity, income, resources, living arrangements, and citizenship or immigration status.

The SSI application process can be initiated online, by phone, or in person at a local Social Security office. After submission, applications undergo a two-step review: first for non-medical eligibility and then for medical determination by state Disability Determination Services. This process typically takes 3-5 months, although certain cases may be expedited.

To improve chances of approval, it’s crucial to thoroughly prepare and document both medical and non-medical eligibility factors. Applicants should be aware that they may be eligible for SSI if they have limited income and resources and meet specific disability criteria. If approved, SSI benefits can begin as early as the month after application submission, with potential retroactive payments.

It’s also important to note that SSI recipients must regularly report changes in income, resources, living arrangements, and medical condition to maintain eligibility. Even after approval, periodic reviews will assess ongoing eligibility. For those denied, a four-level appeal process is available, and seeking assistance from an advocate or the SOAR program can be beneficial.

By understanding the SSI application process and requirements, individuals can better navigate the system and secure the benefits they need. For more information on SSI and disability benefits, it’s recommended to consult the official Social Security Administration resources or seek professional guidance.